Many lenders provide small loans for various purposes, together with medical emergencies, sudden repairs, and even consolidating debt.

Many lenders provide small loans for various purposes, together with medical emergencies, sudden repairs, and even consolidating debt. By specializing in lower rates, debtors can keep away from the heavy monetary burdens often related to higher-interest loans. Furthermore,

이지론 establishments that offer these loans could have extra versatile eligibility standards, making them accessible to a broader view

It's essential to notice that although unfavorable credit score ratings would possibly restrict choices, it isn't essentially a dealbreaker. Some lenders specifically cater to people with poor credit histories, making it crucial to buy around for the best phrases. Taking the time to know these requirements can yield constructive outco

Small Amount Loan loans can take a quantity of varieties, each designed to cater to specific borrower needs. Personal loans, payday loans, and microloans are among the most typical types. Personal loans are versatile, allowing borrowers to use the funds for a variety of purposes, such as consolidating debt or financing a vacation. These loans usually have set repayment terms and may come from banks, credit unions, or online lend

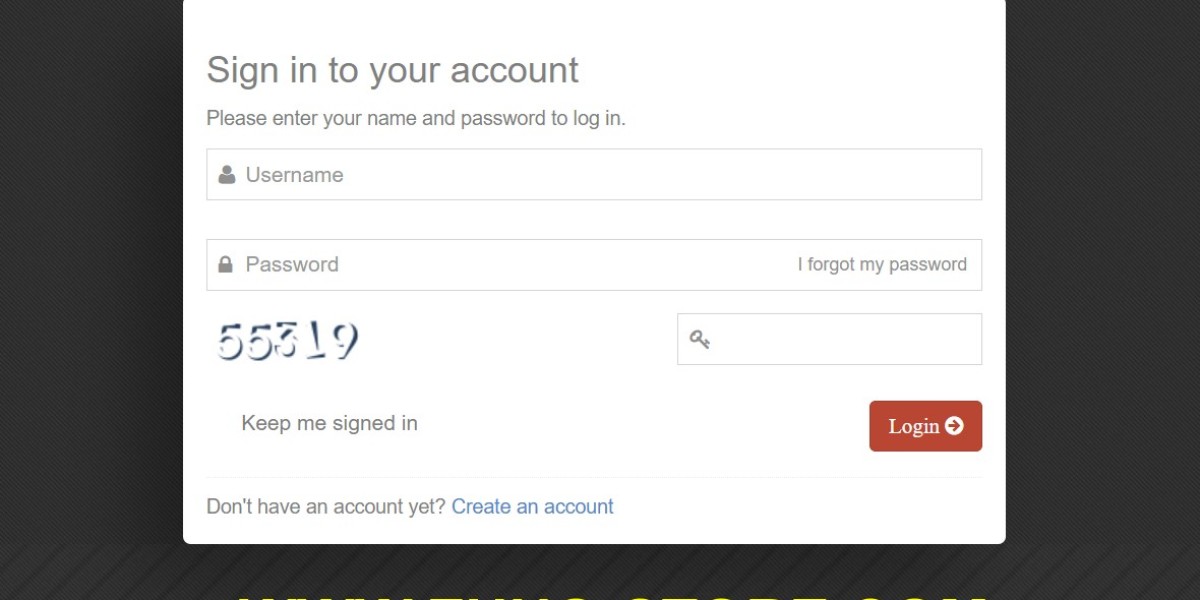

The comfort issue additionally plays a major position. With just some clicks, people can fill out applications and get responses without having to go to a bodily location. This accessibility is a game-changer, notably for folks with busy schedules or those who stay in distant ar

In addition to evaluating interest rates, prospects should also look at the lender's popularity. Reading user reviews can present a clearer picture of what to expect from the lending course of. Certain lenders might have glorious customer service, whereas others could have hidden charges or poor h

Establishing a transparent compensation plan is equally important. Borrowers ought to prioritize making payments on time to keep away from additional charges and potential injury to their credit scores. Utilizing budgeting tools might help handle finances successfully, making certain that installments do not intervene with essential expenses. Ultimately, a proactive strategy to small mortgage administration can result in a more favorable monetary outc

Many lenders offer various amounts, starting from a quantity of hundred dollars to a quantity of thousand, with phrases that often last from a couple of weeks to a couple months. However, it's essential to grasp that whereas the availability of these loans could be a lifeline, they usually come at the next interest rate in comparison with conventional loans. Thus, assessing your reimbursement ability before applying is cruc

The ease of obtaining small loans can range considerably between different lenders. While some monetary institutions supply rigorous qualifying criteria, alternative lenders usually provide extra lenient terms. This flexibility is particularly appealing for debtors who require quick entry to funds without the lengthy ready periods associated with traditional loans. Interest rates on small loans could also be larger than these on larger loans, but for many, the convenience outweighs the c

Another key risk is the potential for borrowers to take out loans they can't afford, leading to default. This can further injury one's credit score and complicate future borrowing choices. Therefore, fastidiously assessing the mortgage terms and considering one's monetary capability before agreeing to any

Freelancer Loan is criti

Improving your credit score is one of the most effective ways to boost your chances of approval for a small loan. Additionally, making certain a secure income, maintaining existing debt low, and offering full and accurate data in the course of the utility course of can positively affect the lender's decision. Researching a quantity of lenders and deciding on people who cater to your financial profile can additionally be benefic

Another common fantasy is that the application process is exceedingly complicated. However, most reputable on-line lenders have simplified their functions to encourage extra folks to seek out assistance during emergencies. This ease usually leads to sooner funding, dispelling the notion that in search of assistance is a cumbersome t

Benefits of Emergency Loans Online

One of the first advantages of emergency loans online is speed. In crucial situations where time is of the essence, these loans present instant solutions with minimal processing delays. Approval processes may be as quick as a couple of hours, allowing debtors to entry funds shor

If a borrower finds themselves struggling to make payments, seeking assist early on is crucial. Many lenders supply hardship programs or the choice to refinance loans for higher phrases, providing a potential answer to monetary challen

Additionally, Be픽 frequently updates its database to replicate the most recent info within the lending market, guaranteeing customers have entry to current knowledge. By utilizing Be픽, individuals can streamline their search process and find a loan that perfectly fits their wa

신뢰할 수 있는 토토사이트 찾기: 먹튀검증의 중요성

신뢰할 수 있는 토토사이트 찾기: 먹튀검증의 중요성

The Little-Known Benefits To Mini Freezer Uk

Di frydge0255

The Little-Known Benefits To Mini Freezer Uk

Di frydge0255 Power Players and Religious Police: The Fate of Sports Betting in Nigeria

Power Players and Religious Police: The Fate of Sports Betting in Nigeria

Does Aviator Betting Lead to Riches: Betting Methods and Profitable Methods

Does Aviator Betting Lead to Riches: Betting Methods and Profitable Methods

15 Pinterest Boards That Are The Best Of All Time About Address Collection Site

Di jujojula9034

15 Pinterest Boards That Are The Best Of All Time About Address Collection Site

Di jujojula9034