This construction is especially helpful during emergencies, giving borrowers instant entry to money once they need it most.

This construction is especially helpful during emergencies, giving borrowers instant entry to money once they need it most. Eligibility for these loans can differ, however generally, lenders look for a steady income and a credit score history. However, the emphasis is often on the borrower's capability to repay quite than their credit score rating, making these loans accessible to a wider audie

Online installment loans have turn into a popular financial product, permitting borrowers to manage their finances successfully. This article delves into the nuances of online installment loans, what they entail, their advantages, and potential pitfalls. We'll also highlight BePick, a devoted website that offers detailed information and critiques on installment loans, assisting

Personal Money Loan customers in making informed decisi

Additionally, a few on-line lenders might interact in predatory practices, corresponding to charging exorbitant charges or offering loans that debtors cannot feasibly repay. It's crucial to do thorough analysis and keep away from lenders that seem doubtful or untrustwor

Tips for Choosing a Reliable Lender

When looking for an online cash advance mortgage, selecting a reliable lender is paramount. A reliable lender must be clearly licensed and have a stable status backed by constructive customer reviews. Researching completely different lenders on platforms similar to 베픽 can provide useful insights and comparisons, serving to debtors make knowledgeable selecti

Furthermore, BePick updates its content material regularly to replicate changes within the lending landscape, including new loan products, interest rates, and regulations. This dedication to providing up-to-date info helps users make well timed and knowledgeable choices, in the end main to higher outco

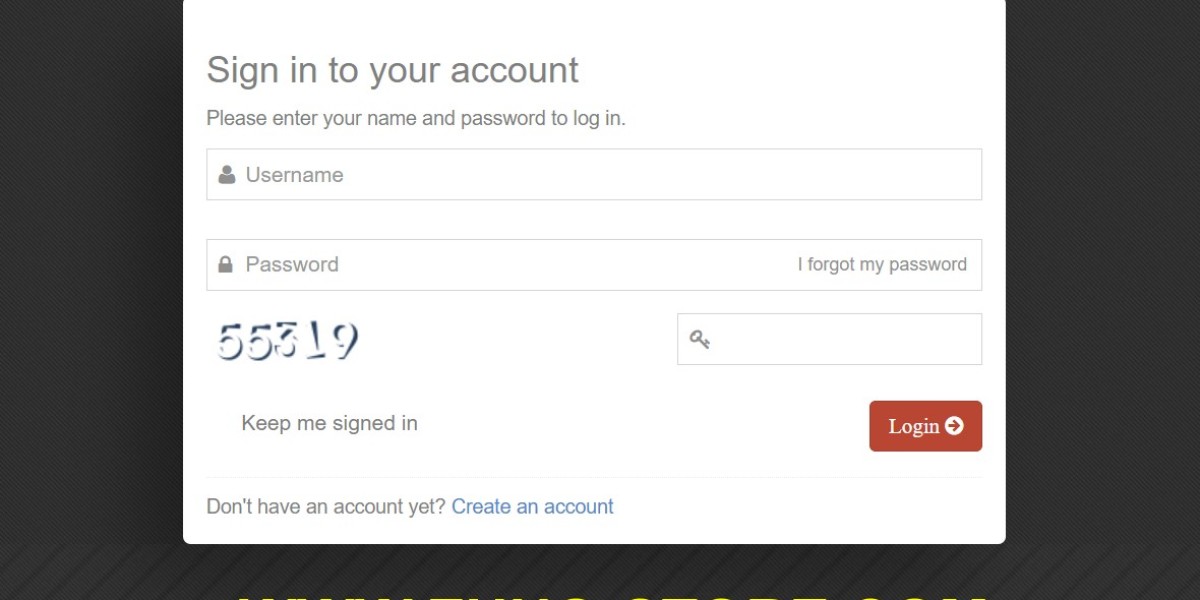

After submission, lenders will review the appliance, usually offering a choice nearly immediately. If permitted, the funds can be deposited into the borrower’s checking account as rapidly as the identical day or within 24 hours. This speed makes online cash advance loans particularly in style amongst those in pressing need of economic h

Online loans for unfavorable credit ratings are monetary merchandise that cater to borrowers who might not qualify for conventional financial institution loans because of a poor credit score rating. These loans can help individuals cover emergencies, consolidate debt, or fund needed purchases. Unlike conventional lenders, on-line lending firms sometimes use various knowledge corresponding to revenue stage and employment history to evaluate creditworthin

When surprising bills arise, many find themselves looking for instant monetary solutions. Installment loans with fast funding offer a viable choice, permitting individuals to address pressing needs whereas spreading repayments over time. This flexibility is often a lifesaver in times of crisis. As we delve into the world of these loans, it's essential to grasp their mechanics, advantages, and the position of platforms like BePick, which offer priceless insights and reviews associated to such monetary merchand

How to Choose the Right Online Lender

Selecting the right online lender is a vital side of securing a web-based installment loan. Prospective debtors should start by researching varied lenders and assessing their reputations. Reviews and testimonials from different prospects can present useful insights into the lender’s trustworthiness and reliabil

Exploring 베픽 for Loan Information

For individuals seeking deeper insights into online money advance loans, 베픽 stands out as a useful resource. The platform offers detailed critiques, comparisons, and data on various lenders, enabling users to make educated decisions about their borrowing choices. Access to expert articles and actual customer reviews can present important views on the professionals and cons of different mortgage merchand

Selecting the right online mortgage for medical bills includes careful consideration. First, assess the total amount needed for medical expenses. Understanding the entire financial picture, together with insurance coverage and out-of-pocket costs, might help you establish the best loan amo

The Role of BePick

BePick serves as a complete useful resource for individuals seeking detailed information about installment loans with quick funding. The platform provides a extensive selection of resources, including insightful articles and consumer critiques, to help potential borrowers make informed decisi

Benefits of Online Installment Loans

One of probably the most important

Personal Money Loan advantages of on-line installment loans is their accessibility. Borrowers can apply from the consolation of their houses, eliminating the need for in-person visits to banks or credit unions. This ease of access has made it a most popular alternative for m

n Yes, there are a number of alternatives to online loans for medical bills. These include medical credit cards, payment plans supplied by healthcare suppliers, crowdfunding via platforms, and help programs supplied by non-profit organizations. Each option comes with its

Personal Money Loan benefits and disadvantages, so completely researching the best fit for your scenario is cruc

신뢰할 수 있는 토토사이트 찾기: 먹튀검증의 중요성

Tarafından edwinsilcock69

신뢰할 수 있는 토토사이트 찾기: 먹튀검증의 중요성

Tarafından edwinsilcock69 The Little-Known Benefits To Mini Freezer Uk

Tarafından frydge0255

The Little-Known Benefits To Mini Freezer Uk

Tarafından frydge0255 Power Players and Religious Police: The Fate of Sports Betting in Nigeria

Tarafından leonelslate978

Power Players and Religious Police: The Fate of Sports Betting in Nigeria

Tarafından leonelslate978 Does Aviator Betting Lead to Riches: Betting Methods and Profitable Methods

Tarafından ilanasleeman18

Does Aviator Betting Lead to Riches: Betting Methods and Profitable Methods

Tarafından ilanasleeman18 15 Pinterest Boards That Are The Best Of All Time About Address Collection Site

Tarafından jujojula9034

15 Pinterest Boards That Are The Best Of All Time About Address Collection Site

Tarafından jujojula9034